In a very short span of time, India has taken leaps in terms of the development and adoption of online payment systems. For a country that always relied on hard cash to make payments, digital means have not only caught up, but is on par, and will soon overtake cash dealings. It could be the whole #DigitalIndia movement to drive India into becoming a cashless society, or maybe the horror of having to stand in bank lines for days when one fine morning, the money you hold is no longer legal tender (courtesy PM dearest).

The world of online payments

Reasons aside, have you ever wondered what takes place when you make an instant online payment to shop for apparel online? What happens in those few seconds between entering your card details and receiving the “Transaction Successful” SMS on your phone? What happens when you walk into an Axis Bank ATM with your SBI Card and withdraw money? How do these two different communicate internally and give you the cash you need? Or when you enter your CVV number and pay for a ride through your Uber app?

About NPCI

An organization you’ve probably never heard of, the National Payments Corporation of India touches every one of these transactions. The NPCI is an umbrella organization for operating retail payments and settlement systems in India. The world of finance is intriguing and vast and I jumped at the chance to get a first-hand interaction with the company that provides the infrastructure for the entire banking system in India – physical as well as electronic.

The National Payment Corporation of India has launched a host of digital services since its inception in 2010. Each of these services are aimed at furthering the electronic payment system to make India a financial inclusive economy.

Digital Services

A few of these services include

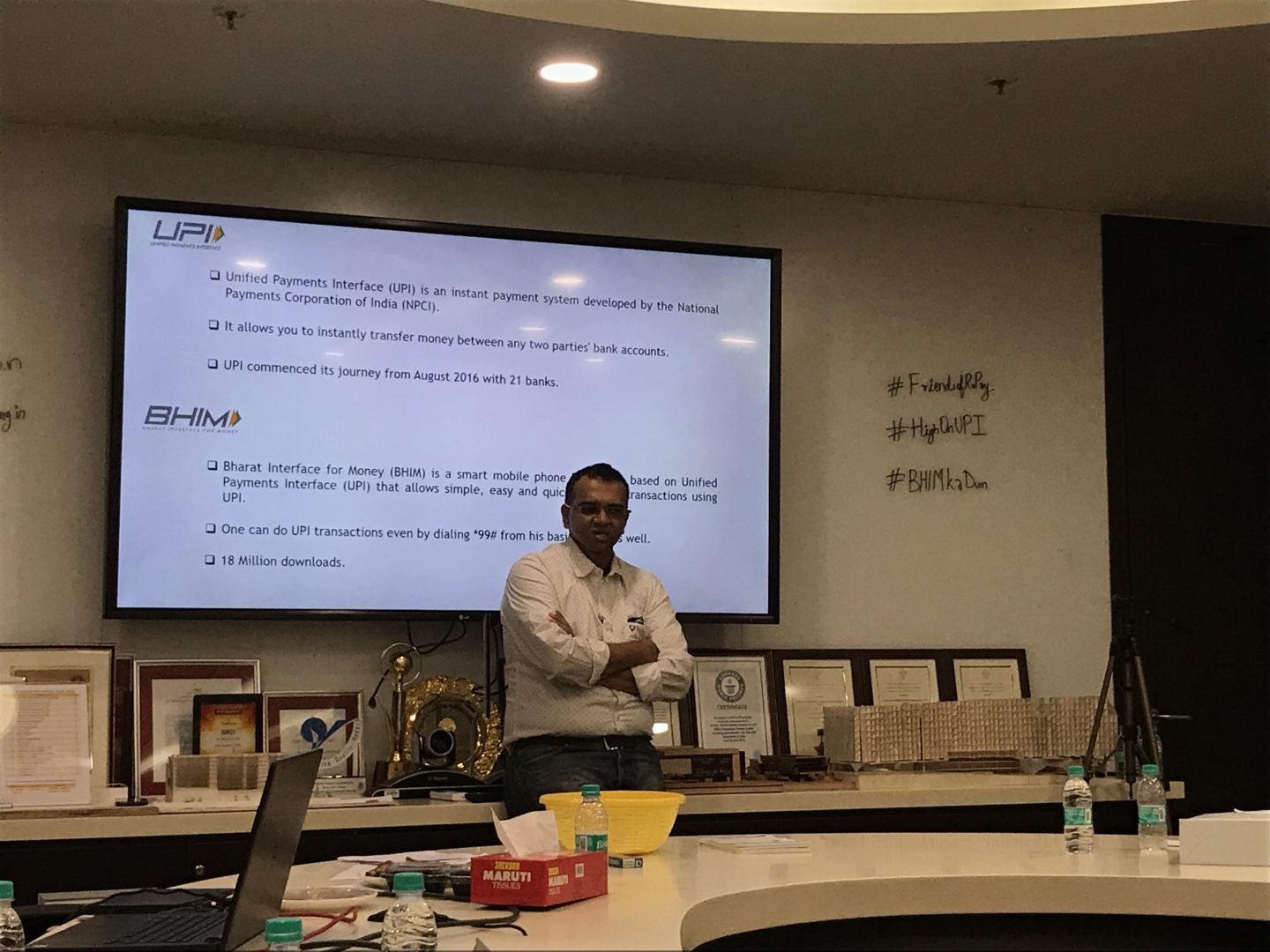

UPI (United Payment Interface which merges multiple bank accounts of any bank into seamless fund routing and merchant payment through an app)

USSD (Unstructured Supplementary Service Data is an app that works without the Internet, enabling transactions to be made by Indians all over the country by dialing a common number, *99#)

IMPS (Immediate Payment Service enabling money transfers through banks around the clock through one’s account number and IFSC, Mobile Number or Aadhar Card.)

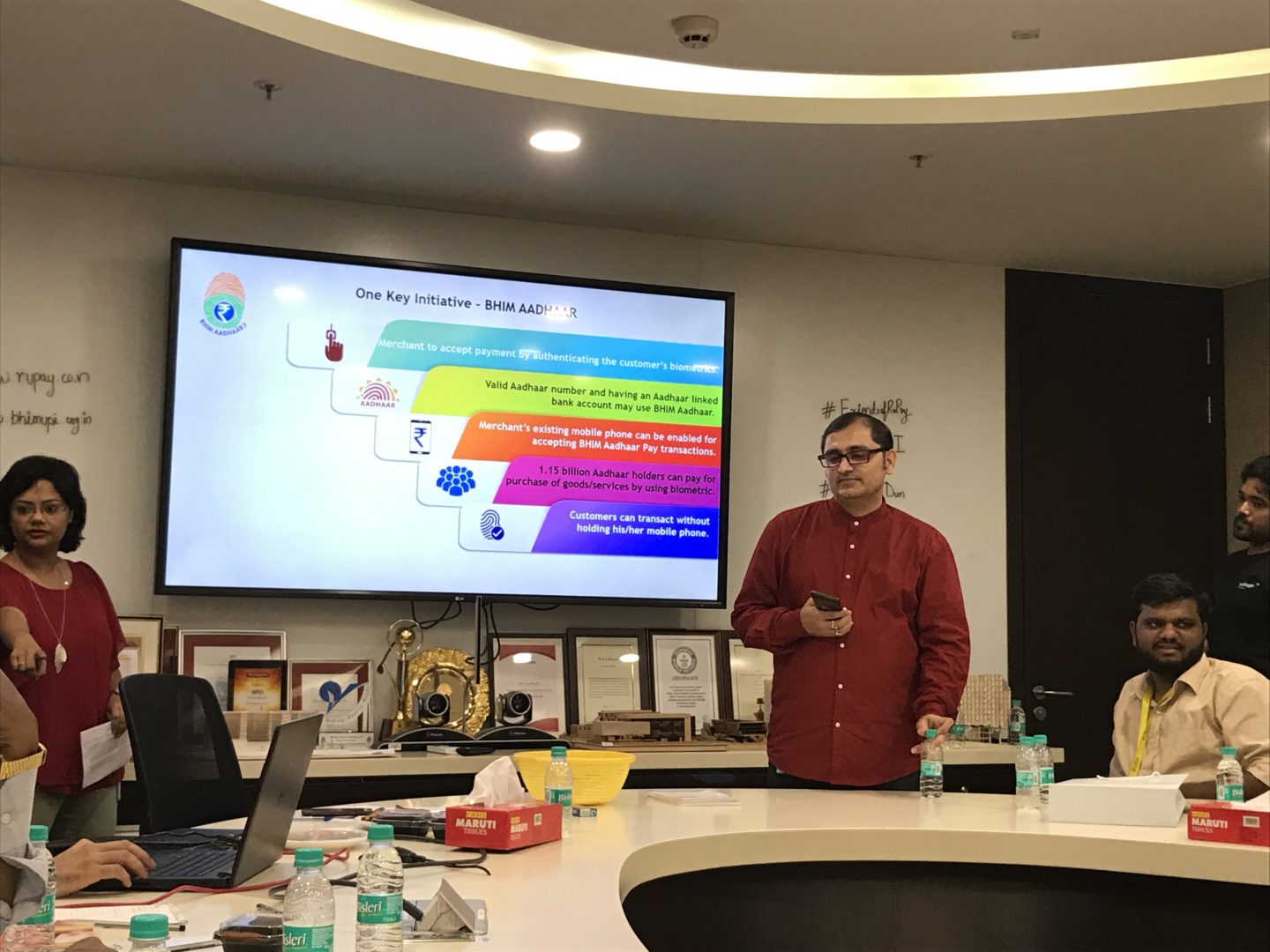

Bhim Aadhaar – An app that allows merchants to accept payment for goods and services by authenticating a customer’s biometrics

Aadhar Enabled Payment System – A bank account linked with Aadhaar information lets you turn your Aadhar card into an ATM Card, allowing users holding an account in one bank to transact through another bank.

Bharat QR – Login to your bank’s app, scan the Bharat QR code at an outlet and pay for goods!

…. And a host of others!

I got an in-depth understanding of two of NPCI’s most popular instruments – RuPay and BHIM

RuPay

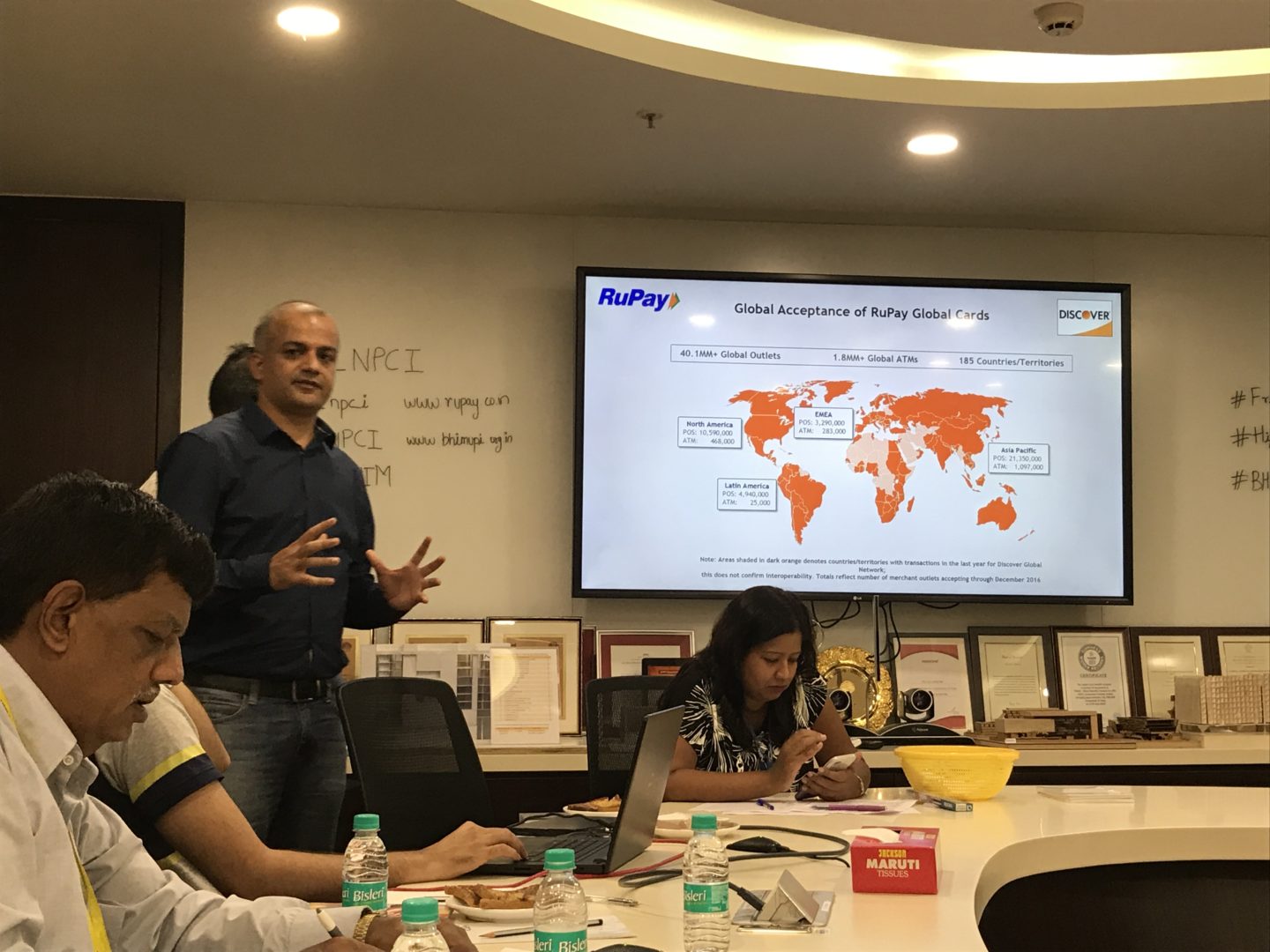

Many of you probably have a RuPay card already. RuPay cards are issued by banks and increase the efficiency of small ticket payments electronically. This is a standardized scheme for all banks in India and currently, Rupay accounts for 30% of ATM transactions plus 22% of all shopping transactions. The figures are rising due to some lucrative offers RuPay Card holders can avail of such as deals at dining outlets, shopping, jewellery, lounge access, and more.

800+ banks are currently participating with 380 million cards issued already. Within the existing debit card space, Rupay offers different products for different segments and offers payment options across channels – ATMs, POS, E-commerce and Aadhar based transactions on micro ATMS. The switching fees are almost 1/3rd that of International Card Schemes (ICS). RuPay has a strategic tie up with Discover Financial Services and Japan Credit Beaureau to offer international acceptance globally.

BHIM

BHIM allows you to go cashless anywhere, at any time yet have a simple, secure way to pay. This 24×7 instant money transfer service app allows you to scan and pay, collect and receive oney with a click, instantly. A direct bank to bank transfer is possible using a mobile number/aadhar card/account number and IFSC code. Users can also generate and share a personal QR code and receive instant notifications for every transaction. No more running to ATMs and rendering exact change!

The informative session I had with Mr. Kunal Kalawatia (SVP Marketing and Branding), Deep Sood (AVP – Product Development- RuPay), and Anubhav Sharma (AVP – Product Development – BHIM) was intense. I’ve tried to cover the salient points in this blog post, but if you have any questions, comment below and I’ll try my best to answer them.

Hope you enjoyed this change of pace on That Goan Girl. See you next time!